Waiting times at major Chinese ports have climbed to their highest levels in more than three years. Sea Analytics shows that the average waiting time has increased by approximately 30% over the past two weeks. For comparison, the typical week-on-week variation is usually within ±5%, underscoring just how significant this shift is.

*The information included reflects market developments and available data as of 28 October 2025.

The rise is both sharp and swift. The last time congestion levels climbed this quickly was during mid-2021, when rolling Covid lockdowns disrupted port operations across China. However, the spike was more gradual, rising by about 25% over a six-week period. This time, the acceleration has been far more abrupt.

A key driver seems to be the continued uncertainty surrounding tariff policy and the potential US – China trade deal. These conditions have led to shifts in shipping schedules, front-loading of cargoes, and last-minute re-routing – putting pressure on terminals already operating near capacity.

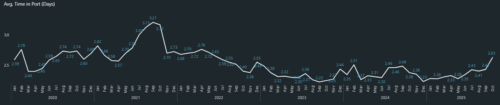

The monthly average time in port – Sea Analytics.

The weekly average time in port – Sea Analytics.

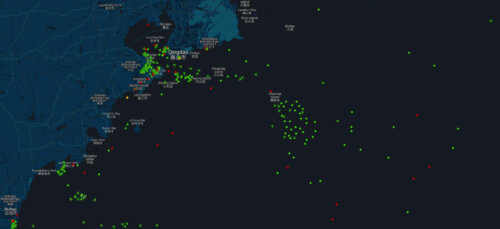

Vessels at Qingdao – Sea Net

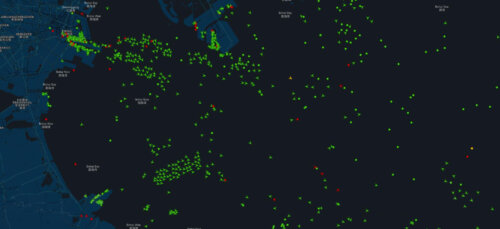

Vessels at Tianjin – Sea Net

The average time in port (in days) in 2025 in Tianjin – Sea Analytics

While it’s too early to determine whether this is a temporary spike or the start of a more prolonged congestion cycle, we will continue to monitor the situation closely. The coming weeks will likely determine whether the situation eases or intensifies further.

Sea’s Intelligence and Analytics equips maritime professionals with the ability to track these trends as they unfold, compare regional congestion patterns, and benchmark performance over time. To learn more, click here.