Connecting the maritime trading ecosystem

Sea delivers a seamless and connected experience to the maritime trading ecosystem. Specifically designed to improve the day-to-day working of shipping professionals, you’ll benefit from better informed trading strategies, stronger collaboration with your peers, and immediate access to real-time data and analytics that ensures your success. All within a single platform.

Data-driven commercial decisions – made easy

With our integrated software solutions for maritime market analytics, pre-trade intelligence, fixture negotiation, and contract management you are set for success. Through our powerful platform commercial decision-making is easy as relevant and actionable data are surfaced in the right place, at the right time – so you can stay ahead of the curve!

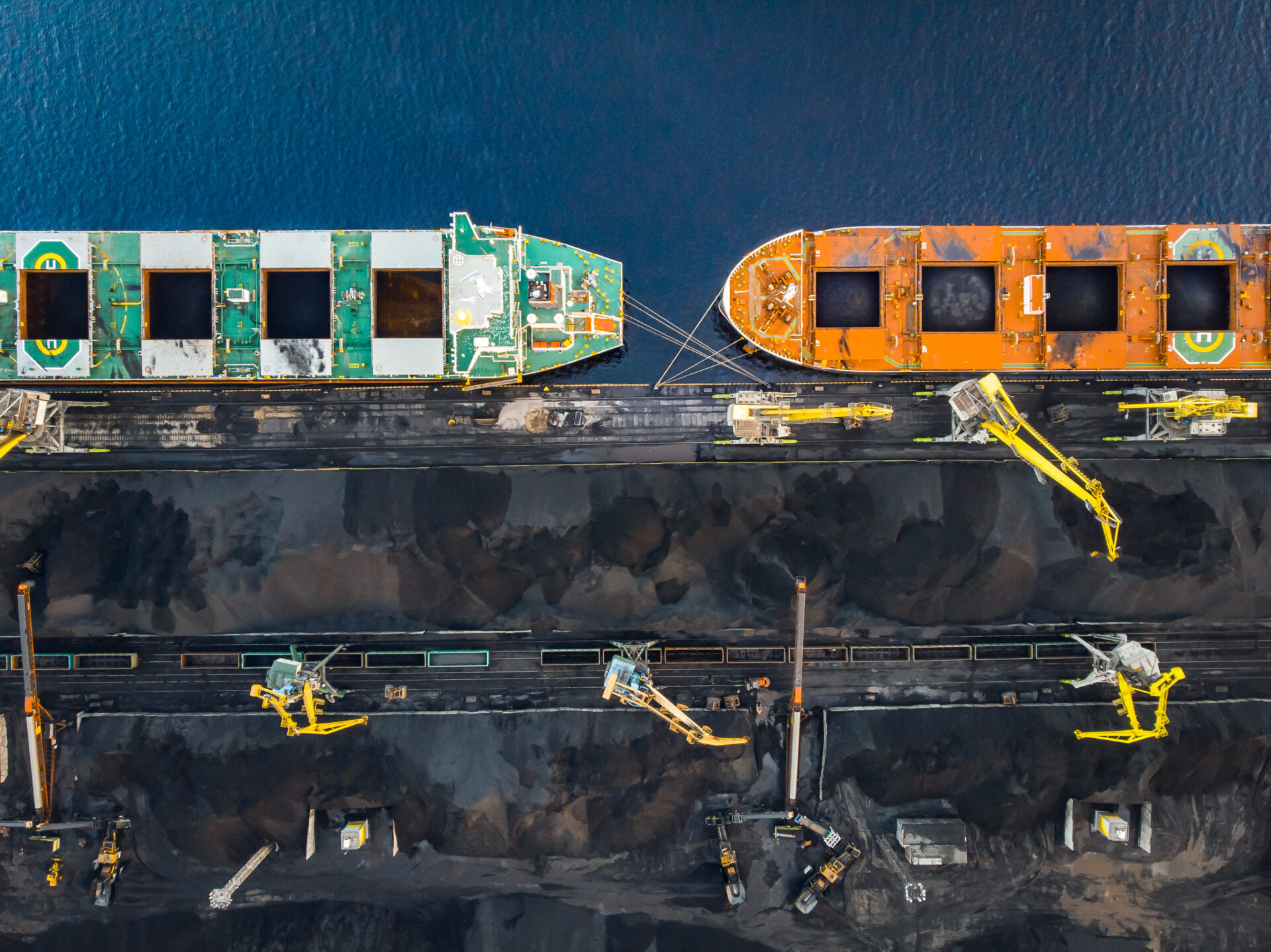

Driving sustainable shipping

To support your sustainable shipping practices, our solutions are developed to enable better decisions at the point of transaction and are championing a green agenda. Through strong data-integrations the platform promotes awareness and adoption of sustainable practices and greener decisions, leading to higher earnings and a reduced carbon footprint.

Strong partnerships for your benefit

To support your daily processes and we are building an ecosystem for the maritime industry that connects charterers, brokers, and owners. Therefore, we partner up and integrate with best-in-class software from RightShip, Veson Nautical, Clarksons Research, Marcura, Polestar, Baltic Exchange, and Windward to facilitate collaboration pre-fixture and at-fixture. Together, we are driving innovation and enabling a new way of working to power better decisions across the industry and enable sustainable shipping.

Discover our digital solutions for streamlining your freight insight and fixture processes

Book a demo to discover the Intelligent Marketplace for Fixing Freight

Please give us a few details about yourself, and our team will be in touch to arrange a bespoke demonstration.