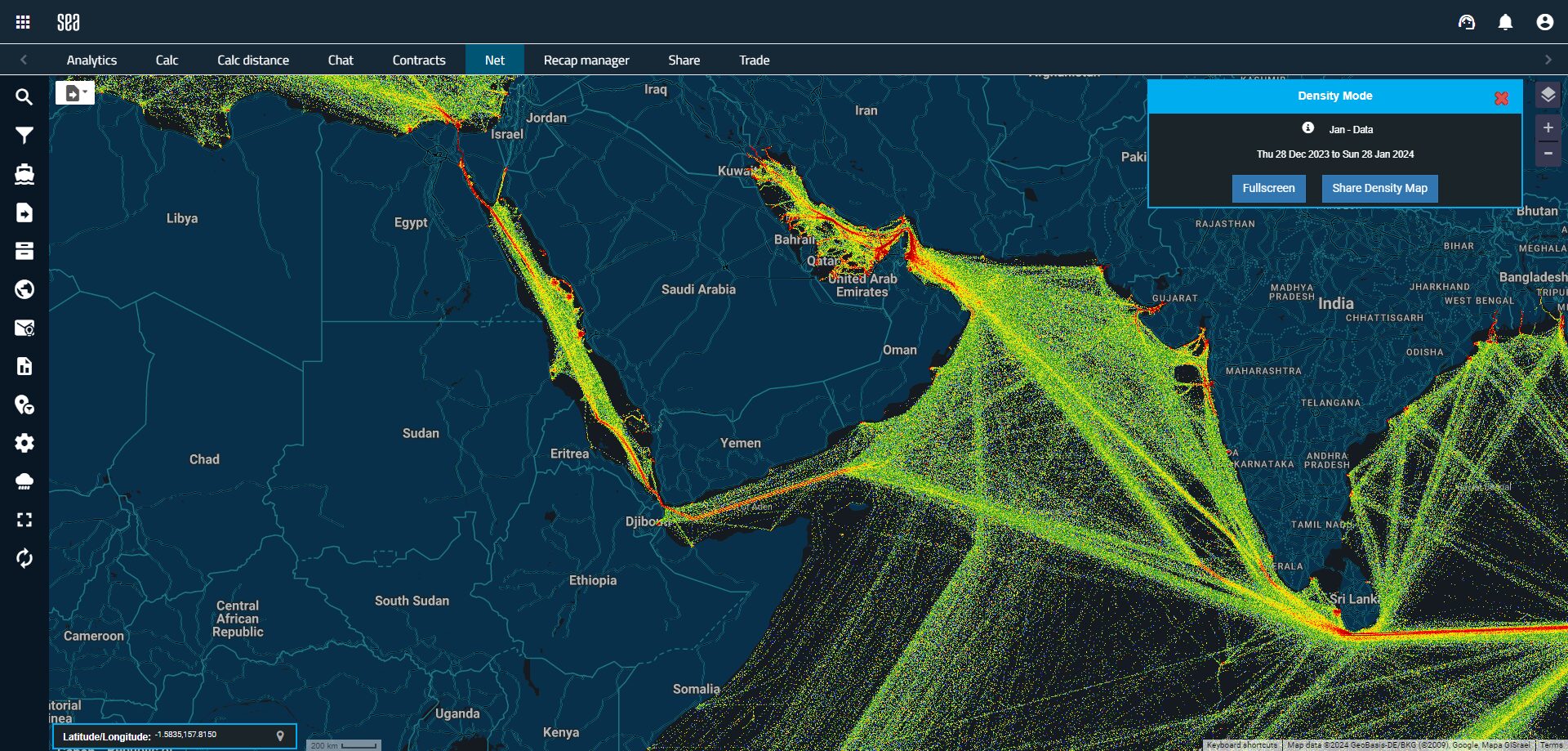

The recent reimposition of US sanctions against Venezuela has abruptly halted the progress observed in the country’s shipping industry following a temporary easing in October 2023, sparking keen interest and scrutiny within the maritime industry. Leveraging detailed data analytics from Sea, we present a comprehensive analysis of the trends and implications of these regulatory shifts.

Eased Sanctions: Delayed Surge in Tanker Callings

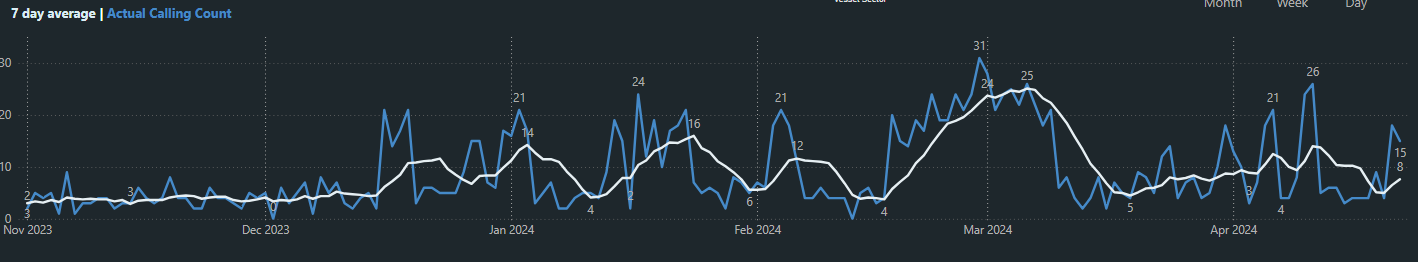

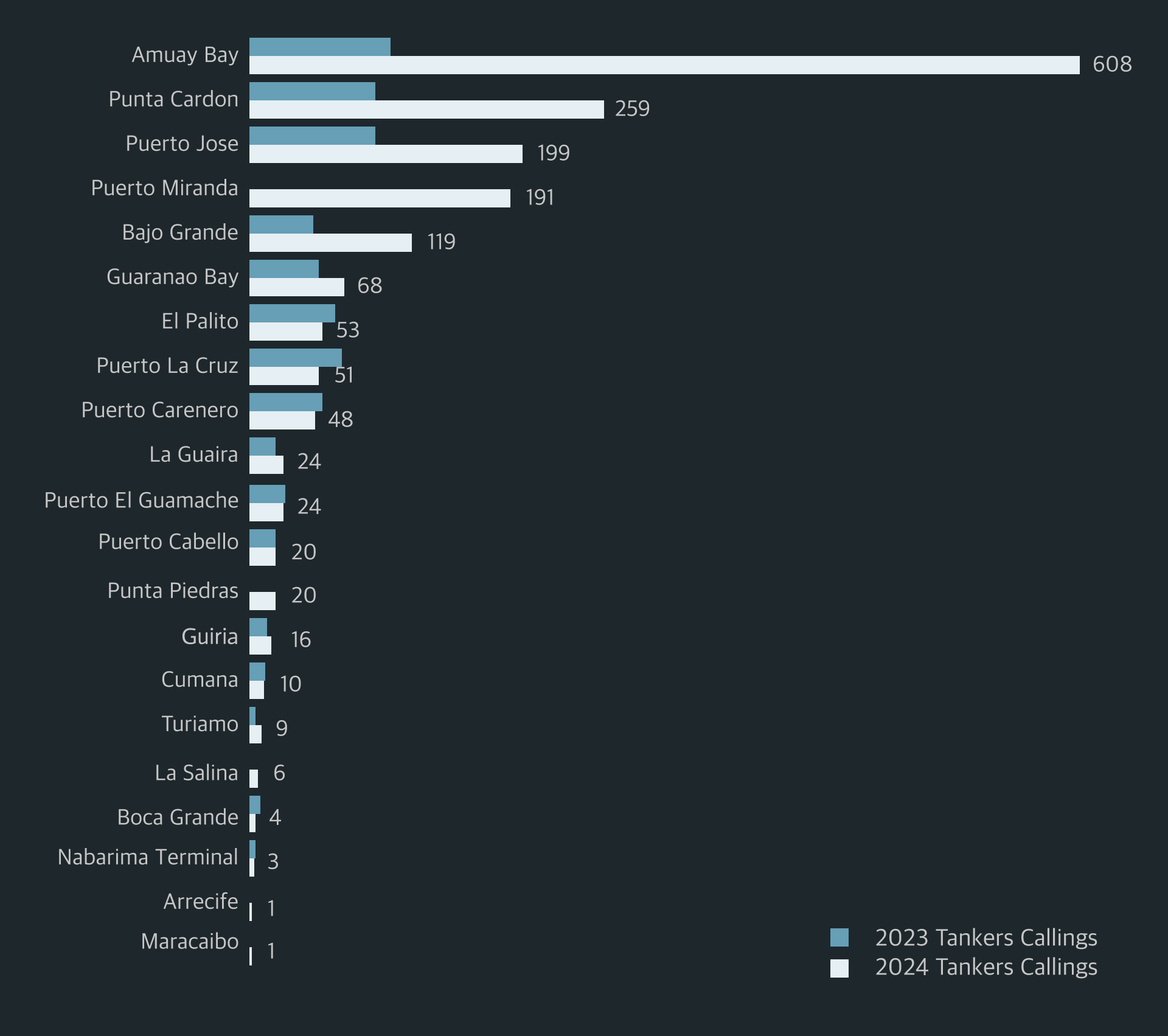

Despite the lifting of US sanctions in October, a surge in tanker activity took longer than anticipated, with a noticeable delay observed until mid-December. However, data from the Sea platform reveals that from then on, the increase in callings was substantial, with activity peaking in early March 2024 having a significant impact on Venezuelan port operations.

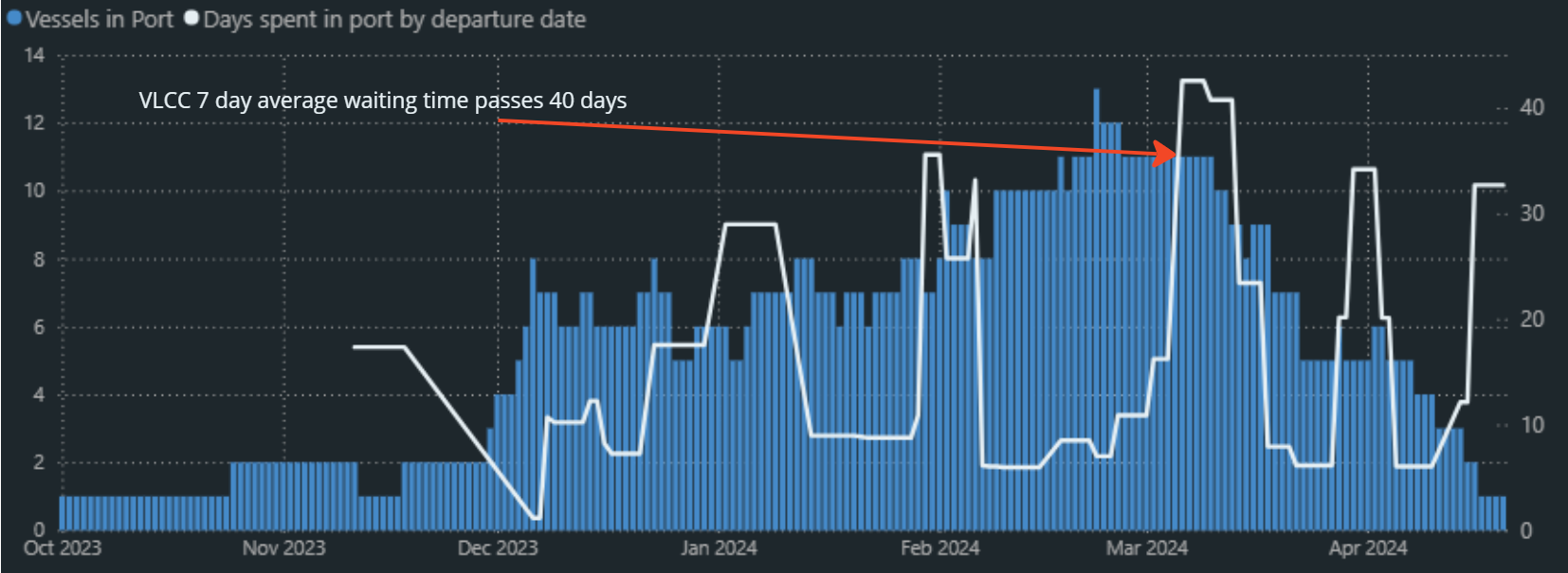

Some ports experienced a remarkable 478% increase in year-on-year calling, and this surge was particularly prominent for larger tankers in particular VLCCs, seeing callings surpass levels not observed since April 2022.

Venezuela sanctions impact on congestion and waiting times – operational challenges

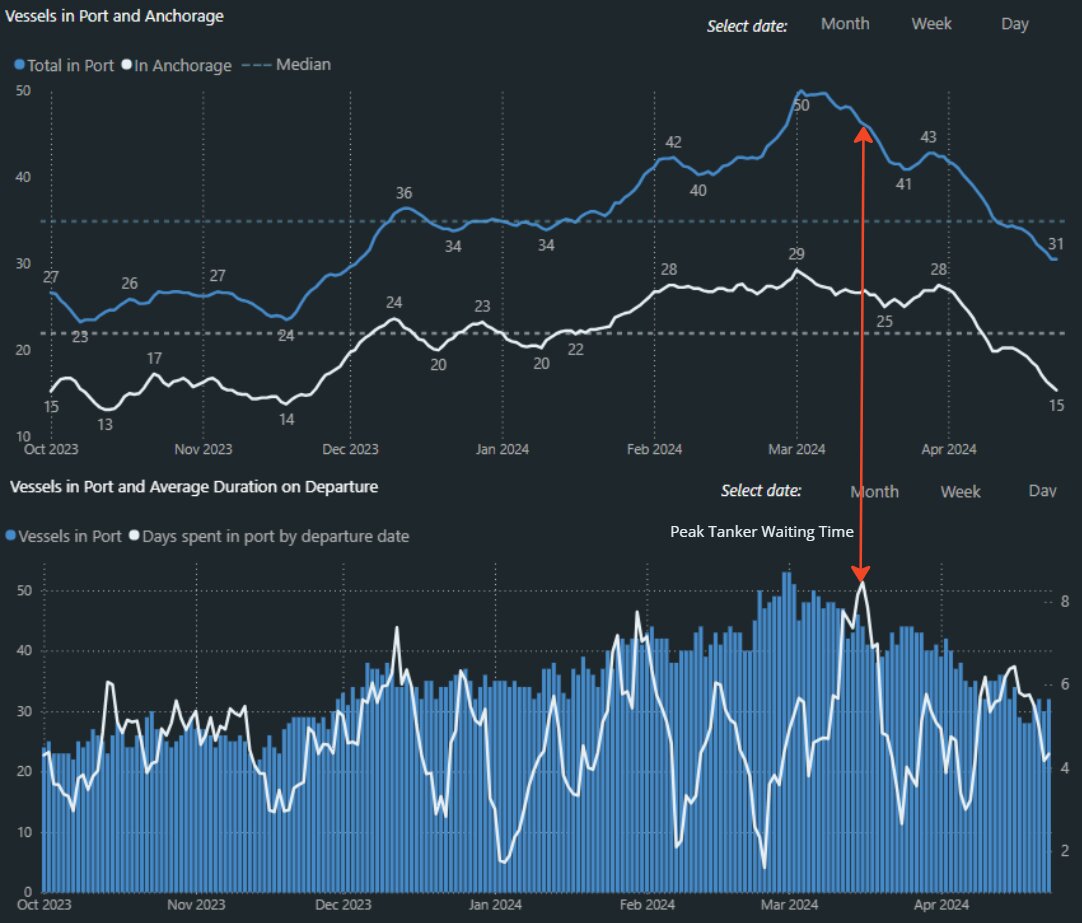

This influx of vessels led to record-breaking congestion levels in Venezuelan ports, with the highest number of tankers present since 2020, with average waiting times for VLCCs peaking at 40 days.

While berthing operations did not observe the same rises, vessels often faced prolonged periods at anchorage awaiting cargo, highlighting the logistical hurdles inherent in fluctuating trade conditions.

Furthermore, reports show PDVSA oil exports increased averaging approximately 600,000 barrels per day with a peak of 750,000 bpd in March 2024, production levels remained below pre-sanction peaks, falling short of the PDVSA target of 1.17 million set in 2023. This suggests that despite strong targets, they have not been able to ramp up production as much as expected to take advantage of the break in sanctions. This gap in their targets may also account for the long waiting times with production unable to keep up with the vessels arriving.

Reimposed Sanctions: Activity Shrinks

With the reintroduction of Venezuela sanctions, vessel activity in the region is currently experiencing a decline. As a result, companies may be likely to be hesitant to engage in trade with Venezuela due to compliance risks, potentially restricting trade partners in the region.

In conclusion, the analytics provided by the Sea platform offer a clearer understanding of the dynamics influencing Venezuela’s shipping industry. By tracking trends in tanker activity, port operations, and waiting times, these insights provide practical guidance for navigating international trade complexities. This data-driven approach equips industry stakeholders to adjust strategies effectively, promoting resilience and informed decision-making within the maritime sector.

To find out more about our Pre-Trade Intelligence and Analytics solutions, click here to fill out a form, and we will contact you shortly.

Share this article

Don’t miss the latest news and insights - subscribe to our newsletter

For press enquiries, please email news@sea.live